RapidLend

Transforming Customer Onboarding, Loan Origination & Credit Card Management

Redefining Financial Services Excellence

RapidLend by RapidData is an innovative platform that empowers financial institutions with a seamless approach to customer onboarding, loan origination, and credit card management. With integrated KYC and compliance capabilities, RapidLend ensures businesses deliver faster, smarter, and more personalized financial services. Developed on the Mendix Low Code platform, RapidLend combines flexibility, speed, and advanced technology to drive operational excellence and customer satisfaction.

Why Choose RapidLend?

Streamlined onboarding, smarter loan origination, and seamless credit management

-

Seamless Customer Experience

Accelerate onboarding and account creation with user-friendly workflows tailored for modern financial institutions.

-

Agility with Low Code

Built on Mendix Low Code, RapidLend enables rapid deployment and easy customization to adapt to business needs.

-

Integrated Technology Ecosystem

Enjoy seamless integration with existing core banking systems and third-party

applications. -

Operational Efficiency

Streamline processes and reduce operational costs through intelligent automation and real-time analytics

Key Features

Powerful tools for efficient financial services and seamless customer experiences

Customer Onboarding

RapidLend streamlines onboarding with intuitive forms, digital uploads, & automated

verification, ensuring a fast & seamless experience.

Loan Origination

Automate the loan lifecycle with RapidLend, covering application, approval, and risk

assessments on one platform

Credit Card Origination

Simplifies credit card origination with intuitive forms, automated scoring, and approval

workflows, ensuring faster approvals

Account Origination

RapidLend allows financial institutions to manage accounts effortlessly with workflows that

ensure personalization, accuracy, and compliance.

KYC & Compliance

RapidLend’s built-in KYC and compliance tools automate due diligence, reducing manual effort,

minimizing errors, and mitigating risks

Workflow Automation

RapidLend streamlines repetitive tasks with intelligent automation, reducing turnaround times

and enhancing team productivity

Key Features

Discover Our range of Personalized and Efficient Features

Customer Onboarding

RapidLend streamlines onboarding with intuitive forms, digital uploads, & automated verification, ensuring a fast & seamless experience.

Loan Origination

Automate the loan lifecycle with RapidLend, covering application, approval, and risk assessments on one platform

Credit Card Origination

Simplifies credit card origination with intuitive forms, automated scoring, and approval workflows, ensuring faster approvals

Account Origination

RapidLend allows financial institutions to manage accounts effortlessly with workflows that ensure personalization, accuracy, and compliance.

KYC & Compliance

RapidLend’s built-in KYC and compliance tools automate due diligence, reducing manual effort, minimizing errors, and mitigating risks

Workflow Automation

RapidLend streamlines repetitive tasks with intelligent automation, reducing turnaround times and enhancing team productivity

Request a Free Demo

Schedule a free demo and get your questions answered by our

experts Team — completely free and commitment-free!

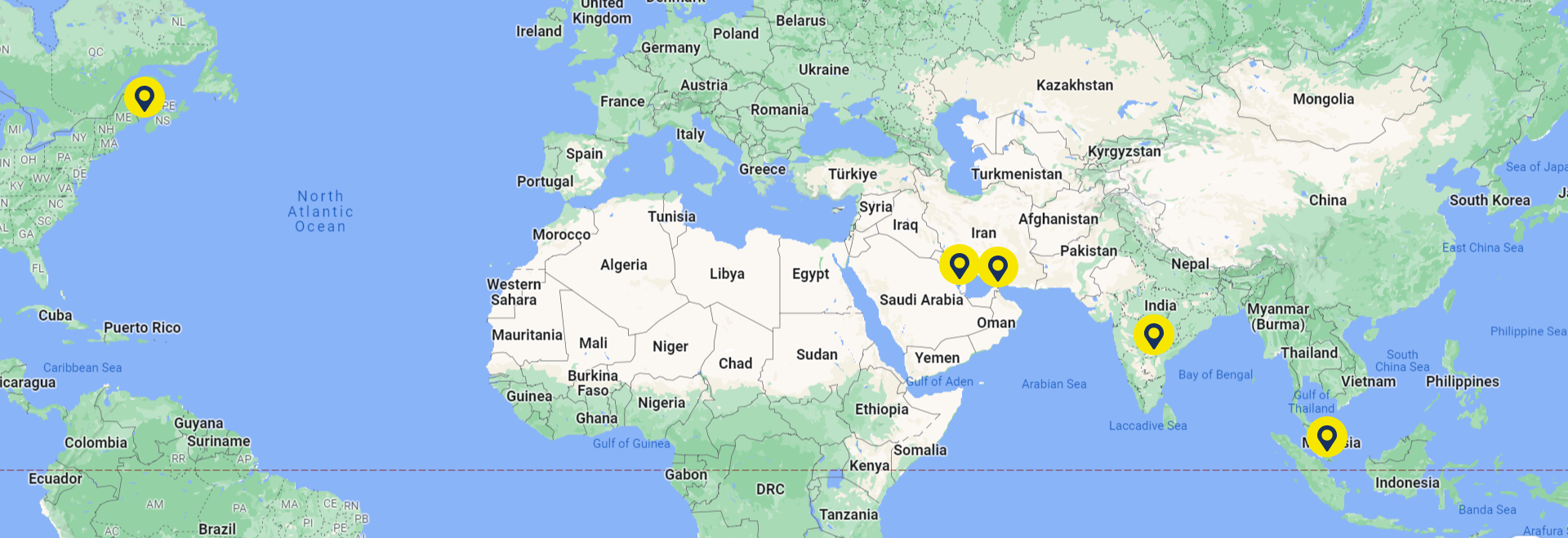

Customer Success Stories

Our Success is best told through the Inspiring Stories of Our Satisfied Clients

The RapidLend Advantage

Enhance efficiency and customer satisfaction with integrated solutions

End-to-End Solution

Covers the entire customer journey, from seamless onboarding to loan origination and ongoing credit card management, ensuring a smooth and efficient experience at every step

Improved Risk Management

Automate risk assessments using advanced credit scoring tools, along with built-in regulatory compliance features, ensuring accurate evaluations and adherence to industry standards

Operational Efficiency

Customize workflows, templates, and responses effortlessly on the Mendix Low Code platform, ensuring rapid deployment and adaptability.Reduce manual effort and operational costs through intelligent automation and streamlined workflows.

Data-Driven Insights

Leverage robust analytics to enhance approval processes, boost customer satisfaction, and uncover growth opportunities. By analyzing data trends and customer behavior, you can make smarter, data-driven decisions, improve operational efficiency, and create experiences that foster long-term loyalty and business growth